With Deltek Time & Expense with ESS, you can cost the labor hours charged. Whether the costs are labor or billing amounts depends on your system configuration. Although most clients do not require this feature, some do, for the following reasons:

The client wants ad-hoc reports to have labor and/or billing amounts.

The client wants the system to calculate and export gross wage amounts because his ERP/Payroll system cannot cost labor properly.

The costing of labor hours can be a complex process, and it is helpful to understand how the system performs the calculation. In order to calculate amounts, the system needs the following information:

Hours - The employee enters hours on the timesheet. Taking into consideration the rate and pay type, the system calculates amounts when the timesheet is saved.

Rate - This is the amount per hour used to calculate the amounts. The source of the rate depends on the system's configuration.

Pay Type (UDT10) - The pay type charged for hours has a direct effect on the amounts calculated. The pay type determines the formula into which the hours and rate are plugged.

Fringe Rate - This rate is the value of fringes paid an employee. This rate applies only if you are using wage determination.

Fringe Reduction Rate - This rate is the value of fringes an employee receives based on benefits. Again, this rate applies only if you are using wage determination.

Deltek Time & Expense with ESS supports two user-defined rates. Each of the user-defined rates has characteristics that make them suited for different purposes. The first user-defined rate is well suited for a labor rate, especially if the labor rate needs to be driven by project, union, locations, labor code, etc. The second user-defined rate is well suited for billing or "burn" rates, where the rates need to be based on project or labor code. To enable user-defined rates, select the Use checkbox and enter a Label in the User-Defined Rates group box in the Miscellaneous tab of the Time Configuration screen.

As mentioned above, user-defined rate 1 is well suited for a labor rate. When an employee charges hours, the system goes through a series of defaults to determine which rate to use. The following items may determine the rate:

Employee - You can specify a user-defined rate 1 for each employee in the Employee History tab of the Employee Information screen. You can download this rate from your ERP/Payroll system or enter it manually.

UDT01 - The UDT01 charged can determine the rate used. See the discussion below for further information. For non-Costpoint clients, this is typically the project.

UDT02 - The UDT02 charged can determine the rate used. See the discussion below for further information.

UDT03 - The UDT03 charged can determine the rate used. See the discussion below for further information. Typically, this field is used for a location code and is useful if you need to determine labor rates by location. This is necessary if you need to support Service Contract Act (SCA) wages.

UDT05 - The UDT05 charged can determine the rate used. See the discussion below for further information. Typically, this field is used for a union code and is useful if you need to determine labor rates by union. This is necessary if you need to support Service Contract Act (SCA) wages.

UDT06 - The UDT06 charged can determine the rate used. See the discussion below for further information. This field can be used for any information not dependent on other UDTs.

UDT07 - The UDT07 charged can determine the rate used. See the discussion below for further information. Typically, this field is used for a labor code and is useful if you need to determine labor rates by labor code. This is necessary if you need to support Service Contract Act (SCA) wages.

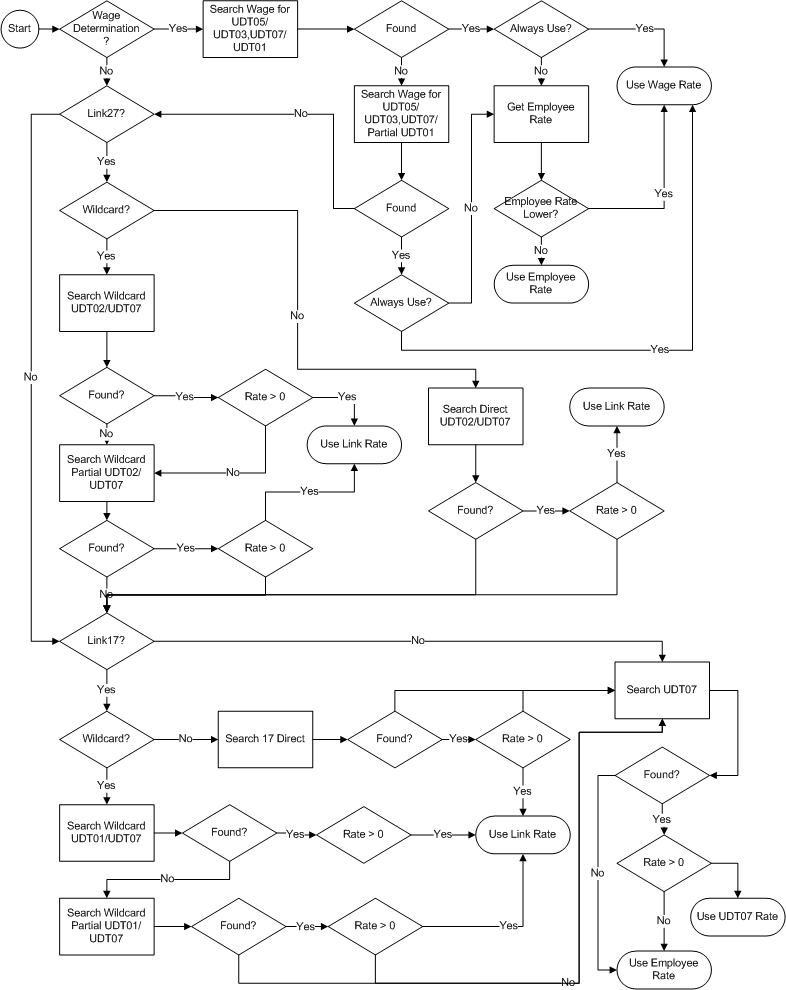

View a diagram depicting the defaulting logic for user-defined rate 1.

Rectangles are processes the system performs, diamonds are decisions the system makes, and ovals are the results. As you study the diagram, see the associated descriptions below.

Search Wage for UDT05/UDT03/UDT07/UDT01 - The system looks at the UDT05, UDT03, UDT07, and UDT01 charged on the timesheet line and searches for an exact match where the wage schedule's effective date is the latest and is earlier than the timesheet hours date. (If you are using enhanced wage determination, the UDT06 is also included when searching for a match.)

Search Wage for UDT05/UDT03/UDT07/Partial UDT01 - The system looks at the UDT05, UDT03, UDT07, and UDT01 charged on the timesheet line and searches for an exact match where the wage schedule's effective date is the latest and is earlier than the timesheet hours date, and the wage schedule's UDT01 is like the UDT01 charged on the timesheet line. (If you are using enhanced wage determination, the UDT06 is also included when searching for a match.)

Get Employee Rate - The system searches the employee history record where the effective date is the latest and is earlier than the timesheet hours date.

Search Wildcard UDT02/UDT07 - The system searches the UDT02/UDT07 Wildcard Link table for an exact match based on the UDT02 and UDT07 on the timesheet line.

Search Wildcard Partial UDT02/UDT07 - The system searches the UDT02/UDT07 Wildcard Link table for an exact UDT07 match and a partial UDT02 match based on the UDT02 and UDT07 on the timesheet line.

Search Direct UDT02/UDT07 - The system searches the UDT02/UDT07 Link table for an exact match based on the UDT02 and UDT07 on the timesheet line.

Search Wildcard UDT01/UDT07 - The system searches the UDT01/UDT07 Wildcard Link table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Search Wildcard Partial UDT01/UDT07 - The system searches the UDT01/UDT07 Wildcard Link table for an exact UDT07 match and a partial UDT01 match based on the UDT01 and UDT07 on the timesheet line.

Search Direct UDT01/UDT07 - The system searches the UDT01/UDT07 Link table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Search UDT07 - The system searches the UDT07 table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Wage Determination? - If you select the Wage Determination check box in the Miscellaneous tab of the Time Configuration screen, the system will access the wage schedule table to determine the appropriate rate. The system will do a series of checks using the UDT01, UDT03, UDT05, and UDT07 codes found on the timesheet line. (If you are using enhanced wage determination, the UDT06 is also included when determining the rate.)

Link27? - The Link UDT02/UDT07 drop-down box in the General Configuration screen determines whether the system is configured to link UDT02 to UDT07.

Link27 Wildcard? - The Link UDT02/UDT07 drop-down box in the General Configuration screen determines whether the system is configured for a Direct or Wildcard link.

Link17? - The Link UDT01/UDT07 drop-down box in the General Configuration screen determines whether the system is configured to link UDT01 to UDT07.

Link17 Wildcard? - The Link UDT01/UDT07 drop-down box in the General configuration screen determines whether the system is configured for a Direct or Wildcard Link.

Always Use? - A drop-down box in the wage schedule determines if you always use the wage schedule rate when located. The other option is to use employee rate if higher.

Employee Rate Lower? - Is the employee rate lower than the located wage schedule rate?

Rate > 0? - For the record found, is the rate greater than zero?

Found? - For the record being searched, is it found?

Result 1

Rate - Wage Schedule Rate

Fringe Rate - Wage Schedule Fringe Rate

Fringe Reduction Rate - Employee Fringe Reduction Rate

Result 2

Rate - Employee Rate

Fringe Rate - Wage Schedule Fringe Rate

Fringe Reduction Rate - Employee Fringe Reduction Rate

Result 3

Rate - Link27 Wildcard Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

Result 4

Rate - Link27 Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

Result 5

Rate - Link17 Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

Result 6

Rate - Link27 Wildcard Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

Result 7

Rate - UDT07 Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

Result 8

Rate - Employee Rate

Fringe Rate - Zero

Fringe Reduction Rate - Zero

As mentioned above, user-defined rate 2 is well suited for a billing rate. When an employee charges hours, the system goes through a series of defaults to determine the rate to use. The following items can determine the rate:

Employee - You can specify a user-defined rate 2 for each employee in the Employee History tab of the Employee Information screen. You can download this rate from your ERP/Payroll system or enter it manually.

UDT01 - The UDT01 charged can determine the rate used. See the discussion below for further information. For non-Costpoint clients, this is typically the project.

UDT02 - The UDT02 charged can determine the rate used. See the discussion below for further information.

UDT07 - The UDT07 charged can determine the rate used. See the discussion below for further information. Typically, this field is used for a billing code, and is useful if you need to determine billing rates by billing code.

View a diagram depicting the defaulting logic for user-defined rate 2.

The Rate 2 diagram depicts the defaulting logic for User Defined Rate 1. Rectangles are processes the system performs, diamonds are decisions the system makes, and ovals are results.

Search Wildcard UDT02/UDT07 - The system searches the UDT02/UDT07 Wildcard Link table for an exact match based on the UDT02 and UDT07 on the timesheet line.

Search Wildcard Partial UDT02/UDT07 - The system searches the UDT02/UDT07 Wildcard Link table for an exact UDT07 match and a partial UDT02 match based on the UDT02 and UDT07 on the timesheet line.

Search Direct UDT02/UDT07 - The system searches the UDT02/UDT07 Link table for an exact match based on the UDT02 and UDT07 on the timesheet line.

Search Wildcard UDT01/UDT07 - The system searches the UDT01/UDT07 Wildcard Link table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Search Wildcard Partial UDT01/UDT07 - The system searches the UDT01/UDT07 Wildcard Link table for an exact UDT07 match and a partial UDT01 match based on the UDT01 and UDT07 on the timesheet line.

Search Direct UDT01/UDT07 - The system searches the UDT01/UDT07 Link table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Search UDT07 - The system searches the UDT07 table for an exact match based on the UDT01 and UDT07 on the timesheet line.

Link27? - The Link UDT02/UDT07 drop-down box in the General Configuration screen determines whether the system is configured to link UDT02 to UDT07.

Link27 Wildcard? - The Link UDT02/UDT07 drop-down box in the General Configuration screen determines whether the system is configured for a Direct or Wildcard Link.

Link17? - The Link UDT01/UDT07 drop-down box in the General Configuration screen determines whether the system is configured to link UDT01 to UDT07.

Link17 Wildcard? - The Link UDT01/UDT07 drop-down box in the General Configuration screen determines whether the system is configured for a Direct or Wildcard link.

Rate > 0? - For the record found, is the rate greater than zero?

Found? - For the record being searched, is it found?

Result 1

Rate - Link27 Wildcard Rate

Result 2

Rate - Link27 Rate

Result 3

Rate - Link17 Rate

Result 4

Rate - Link27 Wildcard Rate

Result 5

Rate - UDT07 Rate

Result 6

Rate - Employee Rate

Once the hours and various rates are known, it is necessary to plug these values into the appropriate formula to calculate the amounts. The formula and certain amounts are determined by the pay type found on the timesheet line. Each pay type is configured for the following:

Calculation Method - This is the formula that the system uses to calculate the amount. The valid formulas are as follows:

(Hours x Rate x Factor) + Fixed Amount

(Hours x Rate x Factor) + (Hours x Fixed Amount)

(Hours x Rate x Factor) + (Hours x Fixed Amount x Factor)

Factor - This value is a multiplier. For example, Hourly Overtime may have a factor of 1.5, whereas Double Time may have a factor of 2.

Fixed Amount - The system adds this value into the calculation. Depending on the formula, this amount is added in, multiplied by hours, or multiplied by hours and a factor.

In addition to the calculation above, if the timesheet line is charged to a UDT that has an applicable wage determination schedule, the system will also include the fringe and fringe reduction amounts in the calculation. The formula for this additional amount is as follows:

(hours x fringe rate) (hours x fringe reduction rate)

The user or supervisor in the cell comments dialog on the timesheet can overwrite the rates used in the calculations. The user can modify the rate if the Modify checkbox in the User-Defined Rates group box in the employee's Timesheet Classes screen is selected. Whether the supervisor can modify the employee's rate is determined by the Modify checkbox for his functional role. Once the rate is changed, select the Calculate pushbutton to recalculate the amount.

The TS_CELL table stores the source of the rates in the s_rate1_cd and s_rate2_cd columns. The values are:

N - None

C - Charge Tree

E - Employee History

M - Manual Entry

1 - Link17/Wildcard

2 - Link27/Wildcard

7 - UDT07

Here are a few examples to show how the calculations are performed. The following information represents a system's configuration:

Employee 1

Rate - 10.00

Employee Fringe Reduction - 5.00

Employee 2

Rate - 20.00

Employee Fringe Reduction - 9.00

Pay Type REG

Calculation Method - (Hours x Rate x Factor) + Fixed Amount

Factor - 1

Fixed Amount - 0

Pay Type - OT

Calculation Method - (Hours x Rate x Factor) + Fixed Amount

Factor - 1.5

Fixed Amount - 0

Pay Type - REGSHFT

Calculation Method - (Hours x Rate x Factor) + (Hours x Fixed Amount)

Factor - 1

Fixed Amount - .50

Pay Type - OTSHFT

Calculation Method - (Hours x Rate x Factor) + (Hours x Fixed Amount x Factor)

Factor - 1.5

Fixed Amount - .50

Wage Schedule for Project XYZ (Certain Location, Union, and Labor Code)

Wage Schedule Rate - 15.00

Apply if Higher than Employee

Fringe Rate - 12.00

Employee |

Project |

Pay Type |

Hours |

Pay Type Calculation |

Fringe Calculation |

Amount |

1 |

ABC |

REG |

8 |

(8 x 10 x 1) + 0 |

|

80.00 |

1 |

XYZ |

REG |

8 |

(8 x 15 x 1) + 0 |

+ (8 x 12) (8 x 5) |

176.00 |

1 |

ABC |

OT |

8 |

(8 x 10 x 1.5) + 0 |

|

120.00 |

1 |

XYZ |

OT |

8 |

(8 x 15 x 1.5) + 0 |

+ (8 x 12) (8 x 5) |

236.00 |

1 |

ABC |

REGSHFT |

8 |

(8 x 10 x 1) + (8 x .50) |

|

84.00 |

1 |

XYZ |

REGSHFT |

8 |

(8 x 10 x 1) + (8 x .50) |

+ (8 x 12) (8 x 5) |

180.00 |

1 |

ABC |

OTSHFT |

8 |

(8 x 10 x 1.5) + (8 x .50 x 1.5) |

|

126.00 |

1 |

XYZ |

OTSHFT |

8 |

(8 x 15 x 1.5) + (8 x .50 x 1.5) |

+ (8 x 12) (8 x 5) |

242.00 |

2 |

ABC |

REG |

8 |

(8 x 20 x 1) + 0 |

|

160.00 |

2 |

XYZ |

REG |

8 |

(8 x 20 x 1) + 0 |

+ (8 x 12) (8 x 9) |

184.00 |

2 |

ABC |

OT |

8 |

(8 x 20 x 1.5) + 0 |

|

240.00 |

2 |

XYZ |

OT |

8 |

(8 x 20 x 1.5) + 0 |

+ (8 x 12) (8 x 9) |

264.00 |

2 |

ABC |

REGSHFT |

8 |

(8 x 20 x 1) + (8 x .50) |

|

164.00 |

2 |

XYZ |

REGSHFT |

8 |

(8 x 20 x 1) + (8 x .50) |

+ (8 x 12) (8 x 9) |

188.00 |

2 |

ABC |

OTSHFT |

8 |

(8 x 20 x 1.5) + (8 x .50 x 1.5) |

|

246.00 |

2 |

XYZ |

OTSHFT |

8 |

(8 x 20 x 1.5) + (8 x .50 x 1.5) |

+ (8 x 12) (8 x 9) |

270.00 |